After conducting a wide range of tests, we have selected an Optical Character Recognition (OCR) provider that complements Advataxes. Considering that our clients’ expenses are mostly incurred in Canada we have put our focus to ascertain receipts from organizations incurring notably travel expenses in Canada are by and large well deciphered.

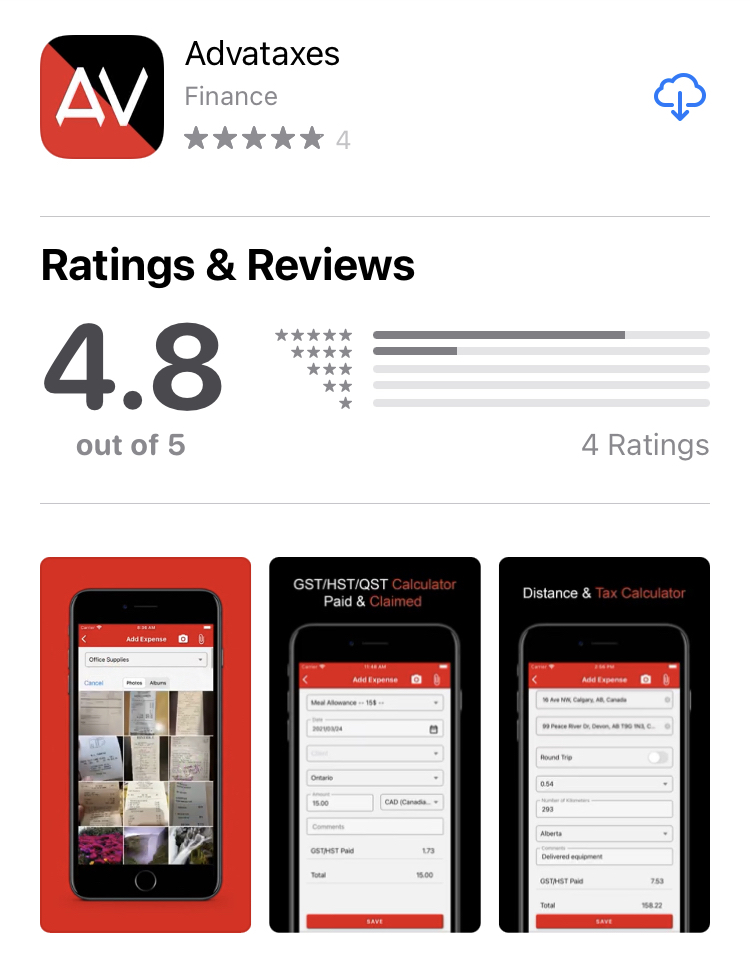

Whether employees of our clients are using their smartphone to upload pictures of their receipts on our mobile app or they are using their laptop/desktop for notably uploading an electronic invoice that they would have received in an email or that they downloaded from the website of their suppliers, Advataxes can now shorten even further the processing time of filling out their expense report. Our clients can now benefit from this technology that uses artificial intelligence.

At the end of the day, our goal is for employees to get their business expenses reimbursed under their company policy, ensure they spend less time preparing their expense report, allow each organization to easily analyze spending, digitalize receipts, and ascertain that recoverable GST/HST and QST are both properly done and maximized. For more information and to view a demo, consult our OCR page on our website.